Carbon Border Adjustment Mechanism (CBAM): The Full Scope of CBAM and Practical Steps Forward

18/01/2024

What is the CBAM?

In 2023, the EU commission agreed to implement the carbon market adjustment mechanism, or CBAM, to reduce the risk of carbon leakage within the EU-ETS framework. Prior to the regulation’s implementation, companies importing goods from outside the EU were not subject to the EU-ETS and therefore, benefited from a competitive advantage by avoiding financial limitations due to their GHG (Greenhouse gas) emissions. However, starting this year, importing companies must report their emissions on the CBAM transitional registry and in 2026 must purchase a certain number of CBAM credits to compensate their emissions. The extent to which CBAM will affect a company will depend on the geographical source of the products and the strength of the carbon policies in this location, e.g. ETS, and carbon tax. Once fully phased in, the CBAM is expected to capture more than 50% of emissions covered by the ETS.

Source - Bakertilly – CBAM less than three months to go

Differences between EUA and CBAM certificate purchasers

Source - Fertilizers Europe - Climate Policy

Who is concerned?

The companies subject to the CBAM are those importing carbon intensive good and at high risk of carbon leakage. These are cement, iron and steel, aluminium, fertilisers, electricity, and hydrogen.

Source - P3 Group: Navigating CBAM - Empower Business in a Carbon Conscious World

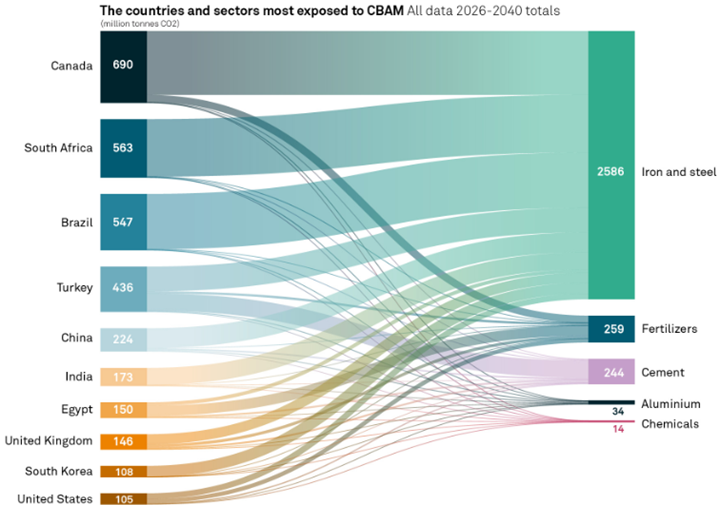

Source - S&P Global: Infographic - Developing economies hit hardest by EU’s carbon border tax

How to comply?

1. Reporting

Until the end of 2024, companies will have one of three ways to report their emissions:

- full reporting according to the new methodology (EU method)

- reporting based on an equivalent method

- reporting based on default reference values

2. Certificate

From 2026 onwards, companies must declare the previous year’s quantity of imported goods and compensate the associated emissions with the purchase and surrender of CBAM certificates. The price of CBAM certificates will depend on the average weekly auction price of EU-ETS allowances.

Unsure how to proceed?

Verifavia, part of the Normec Group, is a globally accredited ISO 17029 independent environmental verification body specializing in transport, F-gas, and heavy industry. Verifavia’s extensive environmental auditing and verification experience in both voluntary and compliance schemes including the EU-ETS will help you navigate and understand unbiased emissions reporting.

> Contact us for more information Back to all Industry News